Company Formation in Bahrain | Complete 2025 Guide

Bahrain is rapidly becoming the most attractive ecosystem for foreign investors looking to establish a business in the Gulf. With 100% foreign ownership, 0% Corporate tax, 0% income tax, and a world-class banking system, it offers the most favorable business environment for company formation in the Middle East.

In this comprehensive 2025 guide to company formation in Bahrain, you will learn:

- Key benefits of setting up a company in Bahrain.

- 7 Simple steps of Bahrain company formation.

- Types of company registration in Bahrain.

- Cost of Company formation in Bahrain

- Company formation Packages

- Business Environment & Regulatory Landscape in Bahrain

Your Company is Just One Form Away!

700+ Completed Applications

Helping investors around the globe with expert support.

Global Expertise

6+ years of experience in business setup.

Authotized Service Provider

We are a Professional Body Regulated by Ministry of Commerce Bahrain

Benefits of Company Formation in Bahrain

Bahrain has positioned itself as a hub for business and investment in the Middle East with its advantageous location, strong economic environment, and business-friendly policies. The company formation in Bahrain for foreigners will give you access to regional markets. The following are the key benefits of company formation in Bahrain:

- No Corporate Tax: Bahrain offers no corporate tax on most businesses, helping you keep more earnings.

- No Income Tax: There is no tax on personal income to worry about in the Kingdom of Bahrain, meaning you can take home all you earn.

- No Third-Party Involvement: You do not need third-party involvement, meaning you control your business.

- 100% Full Ownership: You can have 100% foreign ownership of your company to control it.

- Access to a Highly Skilled Workforce: Bahrain has a skilled and diverse workforce that is ready to meet your business needs.

7 Easy Steps of Company Formation in Bahrain – 2025

Bahrain company registration can be effortlessly accomplished with our seven simple steps. Based on our 6+ years of expertise and the successful completion of over 700 applications, we have designed a streamlined seven-step process for company formation in Bahrain. We understand the legal requirements you must comply with to ensure a successful company registration. This 7-step process involves the approval of various ministries. Each ministry has its requirements, and you must meet them for a successful business registration in Bahrain.

The following is the 7 step process of company formation in Bahrain:

Step # 1: Security Clearance

Security clearance is the first step towards company formation in Bahrain. PI Startup Advisory makes essential KYC (Know Your Customer) documents, and ensures that it possesses all the information in details that meet the regulatory standards.

Requirments:

- Clear Copies of Passports

- Duly Signed KYC Forms

- Duly Signed Engagement Letter

- Authorization Letter

After collecting the above documents, and you have signed, we submit (copies of your passports, authorization letters) to Bahrain’s Nationality, Passport, and Residency Affairs (NPRA) for approval. With our expertise of over 6 years, this process doesn't take too long, and we deliver in a short span of time with complete efficiency.

Processing Time:

Usually takes 3-5 business days

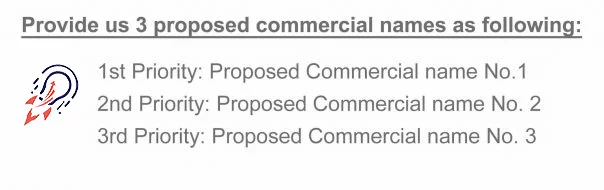

Step # 2. Reserve Commercial Name

In the second step of the company formation in Bahrain, your company needs a unique and compliant business name. We guide you in selecting a name that complies with Bahrain’s regulations while representing your brand. You’ll provide three name options, and we’ll submit them to the MOIC for reservation.

Commercial Name Rules in Bahrain

The following are the rules and regulations for choosing the commercial name of the company:

✅ The business name in Bahrain can be a person’s name or a part of a person’s name.

✅ The business name can be innovative and may include a description of the business activity.

✅ The name must be unique and must not have been registered already.

🚫 The name should not consist of a common word only, such as Mechanical Workshop, Hospital, School, etc.

🚫 It must not contradict the undertaken business activities and local laws & values.

🚫 Cannot be identical to an international brand, religious, political, or military term.

🚫 It should not be a translation or imitation of reputable marks, brands, or third parties.

We ensure your chosen name gets approved quickly so you can confidently move forward.

Requirements:

3 unique business names

Processing Time:

1-3 business days

Step # 3. Register the Head office of The Company

The third step of company formation in Bahrain is registering the head office at the Bahrain Municipality. The business address is submitted to the Bahrain Municipality for pre-approval. After the pre-approval lease contract is signed, the electricity is registered.

The third step of company formation in Bahrain is registering the head office at the Bahrain Municipality. The business address is submitted to the Bahrain Municipality for pre-approval. After the pre-approval lease contract is signed, the electricity is registered.

Requirements:

- Office Photos (Pre-Approval)

- Lease Agreement (After approval)

- Electricity Bill (After approval)

We provide a complete office solution that matches your requirements.

Processing Time:

4-6 Business days

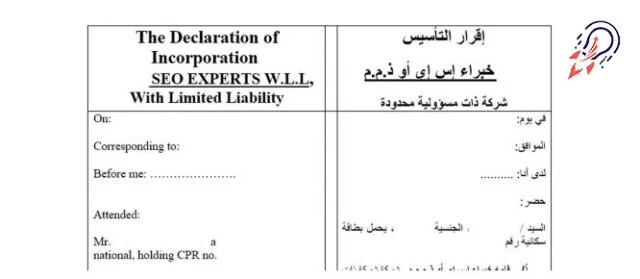

Step # 4. Drafting Deed of Association

Preparing the deed of association is the most essential part of the company formation process in Bahrain. The deed of Association is an important document that details shareholder responsibilities, capital contributions, and company rules. It comprises 27 articles defining the company's specifications, shareholder responsibilities, capital contributions, and company principles.

Once the draft is completed, the documents are submitted to the Ministry of Industry, Commerce, and Tourism (MOIC) for approval and further processing. Completing the deed of association is essential in securing your business’s legal existence in Bahrain.

Requirements:

The draft should be based on the guidelines provided by the Ministry of Industry & Commerce, Bahrain. Click here to view a sample draft.

Processing Time:

1 business day.

Step # 5. Notarize the Deed of Association

The next step in the company formation process in Bahrain is notarizing the Deed of Association from a public or private notary. The PI Startup Advisory team manages the entire notary attestation process for our clients, ensuring a smooth company registration in Bahrain.

Requirements:

For the notarization of the company’s Memorandum (Deed of Association), the following requirements must be met:

⦁ The physical presence of the shareholders is mandatory for company formation in Bahrain.

⦁ The original Power of Attorney is required if an attorney is signing the documents.

⦁ All shareholders must present their original passports to the notary for the company’s registration.

⦁ All shareholders must sign the Memorandum using their Passport Signature, a crucial step in setting up a company in Bahrain.

After the steps mentioned above, we can add notarization to the items we can help you with. We have spent years developing the processes to ensure compliance without delays.

Processing Time:

1 business day

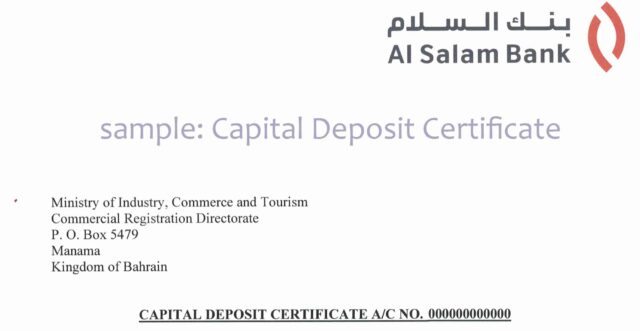

Step # 6. Open a Company Bank Account

As per MOIC Resolution 43 of 2024, opening a bank account in the company’s name is mandatory for company formation in Bahrain. Our banking consultants can open a corporate bank account within 1-3 business days.

We assist you in a swift bank account opening in Bahrain by selecting a suitable Bahraini bank. We will guide you through the account opening process. The company’s bank account is opened in a chosen Bahraini bank, and the capital amount is deposited.

Requirements:

To open a company bank account in Bahrain, the following are the 4 requirements:

- A recent bank statement covering six months in English with a bank seal on each page to verify its authenticity.

- The physical presence of all company shareholders at the bank branch where you intend to open the account.

- Supporting documents that demonstrate your income source, such as business bank statements or salary slips, in case you are employed.

- A business summary outlining the nature and scope of your business, along with a financial plan projecting your expected revenue and expenses.

Processing Time:

Al Salam Bank: 1-2 Business Days

Ithmaar Bank: 5-6 Business days

Ahli United Bank: 3-4 weeks

National Bank of Bahrain: 5-6 weeks

Bank of Bahrain & Kuwait: 1-2 weeks

With our help, this step will go smoothly for you and remain compliant with the financial regulations.

Step # 7. Finalizing Company Registration in Bahrain with MOIC Approval

In this final step, we take the notarized Deed of Association and the capital deposit certificate and submit both documents to the Ministry of Industry, Commerce, and Tourism (MOIC). Once they approve this setup, your business will be registered, and you can legally start your new venture in Bahrain. With this final step, the entire company formation process is now complete.

In this final step, we take the notarized Deed of Association and the capital deposit certificate and submit both documents to the Ministry of Industry, Commerce, and Tourism (MOIC). Once they approve this setup, your business will be registered, and you can legally start your new venture in Bahrain. With this final step, the entire company formation process is now complete.

Requirements:

- Notarized Deed of Association

- Capital Deposit Certificate (Including AML Clauses)

- IBAN Certificate

Processing Time:

1-2 business days.

Types of Company Formation in Bahrain

Bahrain offers a range of possibilities for commercial buildouts. Each has its benefits based on your commercial needs. Lastly, here are the most common types of companies in Bahrain.

With Limited Liability Company (WLL)

A WLL is a private company similar to LLC in other countries where shareholders’ liability is limited to their capital share. There is no minimum capital requirement, but sufficient capital is needed for business objectives. It allows up to 100% foreign ownership and is ideal for small to medium businesses.

Branch of a Foreign Company

In Bahrain, a foreign entity can operate a branch, which exposes the parent company to liability. A branch must be registered with the Ministry of Industry, Commerce, and Tourism (MOICT) and is limited to operating according to the laws of Bahrain. Can operate Parent company business activity only.

Single Person Company (SPC)

An SPC is owned by one individual or corporate entity with limited liability to the capital invested. There’s no minimum capital requirement. Since March 31, 2021, the SPC company registration type has been merged with WLL, offering flexibility on the number of shareholders while limiting liability.

Joint-Stock Company (Public Shareholding Company)

A JSC divides capital into transferable shares, with liability limited to share value. The minimum capital required is BHD 1 million. Suitable for larger businesses seeking public investment and offering shares to the public.

Bahrain Shareholding Company (Closed) – BSC(C)

A joint-stock company where shares aren’t publicly offered. Shareholder liability is limited, with a minimum capital of BHD 250,000. Ideal for companies with a limited number of shareholders.

Bahrain Shareholding Company (Public) – BSC(P)

A public joint-stock company where shares are traded publicly. The minimum capital required is BHD 1 million. It suits large businesses seeking public investment and listing on the stock exchange.

Partnership Company

A general partnership is a structure where two or more partners share profits and are severally liable for obligations. Managed directly by the partners, this structure works well for small businesses or professional firms.

Simple Commandite Company

A limited partnership with general partners (fully liable) and limited partners (liability restricted to their contributions). It offers precise management and investment roles, making it suitable for partnerships with distinct responsibilities.

Bahrain Company Registration Costs:

The cost of company formation in Bahrain can be divided into three sections:

- Licensing and Consulting Cost

- Business Address Cost

- Investor Residency Cost

1. Licensing and Consulting Cost

Licensing and consulting costs can vary depending on your business activities and the quality of service you require. A typical company can be formed in Bahrain for BHD 1000 (excluding the office Address Costs).

Note that our packages include all licensing and consulting costs.

2. Business Address Cost

In Bahrain, having a registered business address is mandatory. The cost varies depending on the office’s type, size, and location. The following are the estimated costs of an office in Bahrain:

- One Month Office Address: BHD 300

- Full Year Business Center address: BHD 1200

- Full Year Incubation Center Address: BHD 600

- a 20sqm Workshop in industrial areas: BHD 150-200

Note that our packages include the cost of a one-month business address.

2. Investor Visa Cost

Obtaining investor residency for all company shareholders is mandatory to complete the company formation process. The cost of investor residency can be as follows:

- Investor Residency Govt Fee: BHD 172

- LMRA Admin Fee: BHD 10

- Investor Post Residency Medical: BHD 20

- Identity Card BHD: 136

- Remote Visa Application: BHD 100

- Remote LMRA Registration: BHD 100

- Scheduling Medical & Biometrics Assistance: BHD 30

Our Packages:

Following are our comprehensive Bahrain business setup packages that match your needs and budget:

Silver Package – BHD 1326

Best for: Solo entrepreneurs and early-stage startups

Processing time: 35–40 business days

Justification:

Designed for budget-conscious clients looking to launch a compliant business with minimal frills, this package includes all mandatory approvals and license formalities. It excludes extras like online banking, VIP support, or meeting space access to keep costs low.

🟢 You get:

Company registration

Business address

Bank account setup

Chamber membership

Compliance basics

📈 Ideal for:

First-time investors, freelancers, and bootstrapped founders starting lean in Bahrain.

Gold Package – BHD 1612

Best for: Established entrepreneurs and growing companies

Processing time: 25–30 business days

Justification:

Offers enhanced features like multi-currency bank account assistance, compliance guidance, and eKey registration. It’s perfect for investors who value time, flexibility, and need broader banking functionality.

🟢 You get everything in Silver, plus:

Compliance support

Multi-currency bank access

Personal bank account help

LMRA and VAT readiness

📈 Ideal for:

Small to medium businesses, returning clients, or investors expanding to the GCC region.

Platinum Package – BHD 2151

Best for: Busy professionals and international investors wanting a VIP experience

Processing time: 11–20 business days

Justification:

This package is tailored for clients who want a hassle-free, fast-track setup with premium features including VIP handling, visit visa assistance, meeting room access, and online banking setup.

🟢 You get everything in Gold, plus:

Priority processing

VIP visa services

Online banking

Office access (meeting room)

Visit visa & post-incorporation support

📈 Ideal for:

Executives, international clients, and business owners who want done-for-you setup with minimal effort and fast results.

Business Environment for Foreign Investors

At PI Startup Advisory, we help our customers navigate the corporate world in Bahrain with startup advisory and specialized company formation services. We meet with our customers, note their needs, and customize our services accordingly. We have also conducted detailed research to give investors a clear picture of Bahrain’s business environment.

Free Zone

Unlike other Gulf countries, the Kingdom of Bahrain has no geographical restrictions. The whole country is a free zone area. Therefore, you can set up a company in any city in Bahrain. However, there are certain restrictions related to business activities

Tax Structure

- Corporate Tax in Bahrain: 0%

- VAT in Bahrain: 10%

- Income Tax in Bahrain: 0%

Read complete article here Taxes in Bahrain & VAT | Simplified – PI Startup Advisory

Share Capital Requirements

- Requirement to deposit capital in a local bank: Yes

- Minimum Capital: No restriction by law.

- Public disclosure of Share Capital: Yes.

- Capital in cash: Allowed.

- Capital in kind: Allowed.

- Debentures: Allowed for Bahraini Shareholding Companies Only

Public Disclosure of Annual Reports

- WLL Companies: No

- Single Person Companies: No

- Bahraini Shareholding Company: Yes

- Foreign Branch: No

- Partnership Company: No

Foreign Ownership

100% foreign ownership allowed:

- All Nationalities: 379 Business Activities

- American Nationals: 557 Business Activities

- GCC Nationals: 570 Business Activities

- Singaporeans: 391 Business Activities

- Icelander, Liechtensteiner, Norwegian, Swiss: 405 Business Activities

99.99% foreign ownership allowed:

49% foreign ownership allowed:

Banking

- Requirement for the personal presence of Shareholders to open a company account: Yes

- Online Banking: Available

- Corporate Debit Card: Available for single-member companies

- Current Account: Available

- Saving Account: Available

- International Funds Transfer: Available

- Trade Instruments: Available

Organizational Structure

- Minimum Shareholders: 1

- Maximum Shareholders: Unlimited

- The requirement of local Directors: No

- Residency of Directors: Not Required

- Residency of Shareholders: Required by banks

- Residency of Authorized Signatories: Not Required

Regulatory Bodies

- Commercial Register: The Ministry of Industry, Commerce & Tourism (MOIC) is responsible for commercial registration in Bahrain.

- Commercial Law: All commercial companies in Bahrain are regulated by the Commercial Companies Law, Bahrain DECREE LAW NO. (21) OF 2001.

- Employment Regulation: The Labour Market Regulatory Authority, Bahrain (LMRA), is responsible for implementing the Labour Law in Bahrain.

- Tax Regulation: The National Bureau for Revenue (NBR) implements tax regulations in the Kingdom. Currently, the only tax in Bahrain is VAT, which is 10%.

Business Development Programs

- Incubation Centers: Available

- Business Development Loans: Available

- Govt Support Programs: Available

- Business Centers: Available

Start Your Business in Bahrain Today!

PI Startup Advisory is ready to assist you in the company setup process, from paperwork to licensing. Contact us today for a free consultation!

Our Services in Bahrain

At PI Startup Advisory, we have a variety of services catering to entrepreneurs and businesses who want to set up in Bahrain. Our qualified team provides hassle-free services, from company formation to residency solutions. We have the core services we offer below:

Company Formation in Bahrain

All-inclusive services that help you register and set up your business in Bahrain while meeting the local laws and requirements.

WLL Company Formation in Bahrain

Specialized assistance for establishing a WLL (With Limited Liability) company, an ideal structure for businesses looking for flexibility and liability protection.

Business Visa Services

We assist with obtaining the Sponsored Business Visa, ensuring all necessary documentation is completed accurately and efficiently for foreign investors and business owners.

Bahrain Business Licenses

We help businesses acquire the necessary licenses, including commercial and industrial permits, to operate in Bahrain legally.

PRO Services

Our Public Relations Officer (PRO) services assist with the bureaucratic processes of working with government authorities, ensuring smooth operations and compliance.

Bank Account Setup Assistance

Support opening a corporate bank account in Bahrain, ensuring your company’s financial operations are set up with the right bank to suit your business needs.

Business Visa in Bahrain

Acquiring an appropriate visa is essential for forming a business in Bahrain. We offer individualized assistance with business visa services in Bahrain, emphasizing sponsored business visas for investors and foreign business owners. Business visas allow business owners to operate and remain in Bahrain while sponsoring their employees.

Processing Time: 5-10 Business Days

Required Documents:

- Valid passport copy

- Proof of business ownership or partnership

- Medical fitness certificate

- Application form

One Chat Could Save You Hours of Research.

Company formation in Bahrain doesn’t have to be complicated. Ask us anything, and you’ll get real answers from real experts right on WhatsApp.

PI Startup Advisory

Why Choose PI Startup Advisory for Company Formation in Bahrain?

Below are some of the reasons why PI Startup Advisory is the go-to source for business formation in Bahrain:

Best Company Formation Agents in Bahrain: With more than 6 years of experience, our experts have a treasure trove of knowledge to ensure that your business set-up process follows regulations.

Full Business Setup Assistance: We assist with all processes, from registering the business and securing licenses to opening your business bank account.

No Hidden Expenses: We aim to be transparent with our customers. Our rates are similar but, above all, open so you know what to expect.

Quick Registration: We expedite the process of company formation in Bahrain so that you can have your business up and running as quickly as possible.

Frequently Asked Questions

How long does company formation in Bahrain take?

The company formation in Bahrain typically takes 1 to 3 weeks, depending on the company’s nature and the required approvals.

Can a foreigner set up a company in Bahrain?

Yes, definitely! Bahrain encourages foreign investment and permits 100% ownership in most industries.

How much does it cost to set up a company in Bahrain?

Fees vary depending on the company type, office, and other required services, but they are usually about BD 1,326.

What are the tax benefits for companies in Bahrain?

Bahrain is a tax-free environment for businesses in most industries, and no corporate income tax or VAT is available.

What is the minimum capital of a company in Bahrain?

The minimum capital depends on the company type. For most businesses, like WLLs, it’s BHD 20,000. Some structures, like Single-Person Companies (SPCs), have no minimum, while financial companies may require more.