Company Formation in Bahrain: Complete 2026 Official Guide

Business owners benefit from the Ministry of Industry and Commerce's efficient oversight through the Sijilat portal, enabling most registration steps to complete electronically within 11 to 21 business days.

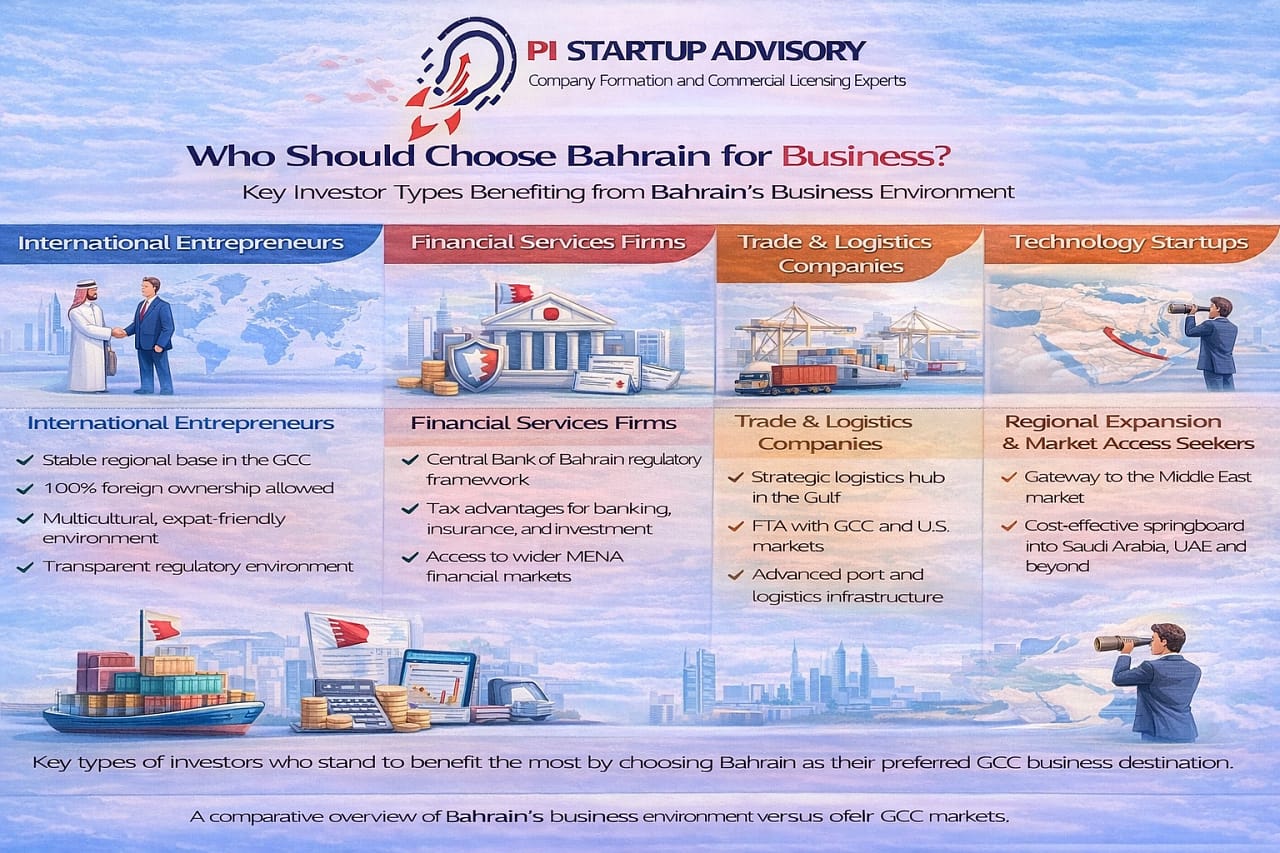

Why Choose Bahrain for International Business

- 0% personal income tax on employment income

- 0% corporate income tax (most sectors)

- No withholding tax on dividends or profit repatriation

- 10% Value Added Tax on applicable goods and services

- No capital gains taxation

Strategic Location and Market Access

Bahrain’s position within the Gulf Cooperation Council provides direct access to the substantial GCC markets. This strategic location enables companies to serve customers across Saudi Arabia, the United Arab Emirates, and neighboring economies from a single base.

The country’s advanced infrastructure connects businesses to the broader Middle East through world-class ports, a modern airport, and digital connectivity that rivals any Business Hub globally.

Zero Tax Environment

Unlike most jurisdictions, Bahrain operates without corporate tax or corporate income tax for the majority of commercial activities. The exceptions are limited to oil and gas operations and specific banking categories.

Tax advantages include:

This favorable tax framework positions Bahrain competitively against other international business centers.

100% Foreign Ownership Without Local Sponsor

Foreign investors can own 100% of their Limited Liability Company across 416 approved business activities—no local sponsor or local partner required. This represents a significant advantage over jurisdictions that mandate local shareholding.

American investors benefit from enhanced access to 557 activities under bilateral trade agreements, while entrepreneurs from the United Kingdom, New Zealand, and other nations enjoy similar opportunities.

Advanced Financial Infrastructure

The Central Bank of Bahrain regulates a sophisticated network of financial institutions offering multi-currency accounts, international payment capabilities, and structured corporate banking services. This mature banking sector supports complex business operations while maintaining strict compliance standards.

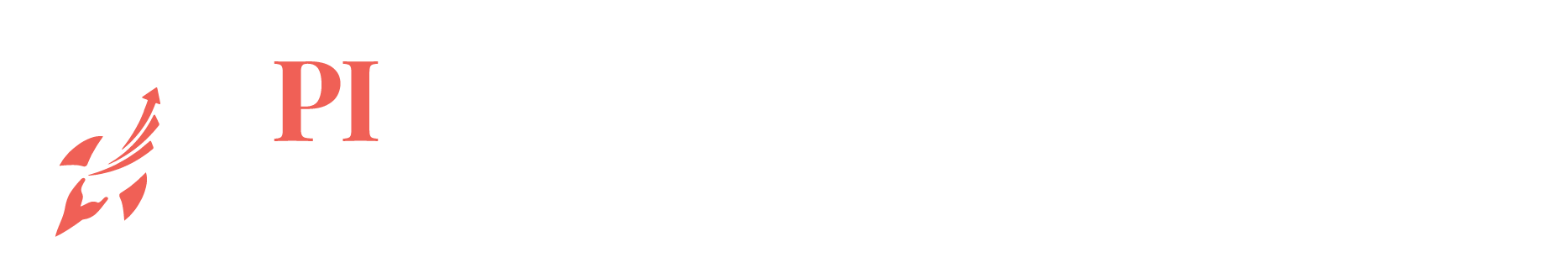

Understanding Company Types in Bahrain

- Shareholders: 2 to 50 permitted

- Liability: Limited to capital contributions

- Minimum Capital: No legal requirement (activity-dependent)

- Management: Appointed manager(s) rather than Board of Directors

- Foreign Ownership: 100% permitted in eligible activities

- Best For: Service providers, trading companies, technology firms, consultancies

- Solo entrepreneurs launching professional services

- Subsidiary structures where a parent company owns 100%

- Individuals requiring liability protection without partners

- Minimum share capital requirements apply

- Shareholders: 2 to 50

- Share transfer restrictions apply

- Requires Board of Directors (minimum 3 members)

- Suitable for family businesses, private equity structures, controlled ownership

- Higher minimum capital requirements

- Unlimited shareholders permitted

- Shares freely transferable

- Can list on Bahrain Bourse

- Enhanced governance and disclosure requirements

- Appropriate for large-scale operations and public offerings

- 100% foreign ownership (extension of parent)

- No minimum capital required in Bahrain

- Simplified registration (no shareholders or Articles of Association)

- Parent company maintains full liability

- Limited activities (cannot own real estate)

- Suitable for project execution, market testing, regional representation

- All partners share unlimited liability

- Joint management by agreement

- No minimum capital requirements

- Common in legal, accounting, consultancy firms

- Combines general partners (unlimited liability) with limited partners (liability capped at contribution)

- Structured investment arrangements

- Professional-investor combinations

Limited Liability Company (W.L.L)

The W.L.L (With Limited Liability) represents the most popular choice for foreign investors establishing a new business. This company structure provides liability protection while maintaining operational flexibility.

Key characteristics:

The WLL company dominates new registrations because it balances legal protection with simplified governance. Your personal assets remain protected while the company operates as an independent legal entity.

Single Person Company (S.P.C)

A Single Person Company allows one shareholder to establish the business independently. This variant of the Limited Liability Company suits:

The registration process mirrors standard W.L.L procedures with adapted governance for single ownership.

Bahrain Shareholding Company (B.S.C)

Larger operations requiring formal governance structures utilize the Bahrain Shareholding Company, available in two variants:

B.S.C Closed (Private Shareholding)

Public Shareholding Company (B.S.C Public)

Both variants require a Board of Directors managing company affairs according to shareholder directives.

Branch of a Foreign Company

International corporations can establish a Branch Office as an extension of their parent company rather than creating a separate legal entity.

Branch characteristics:

A Foreign Branch provides efficient market entry while maintaining centralized control from the parent company’s headquarters.

Representative Office

Companies conducting preliminary market research or liaison activities without generating revenue may establish a Representative Office. This structure limits business operations to:

Market analysis and research

Relationship development with potential partners

Information gathering for parent company decision-making

Direct revenue generation through a representative office is prohibited, making this suitable only for exploratory market entry phases.

Partnership Structures

Traditional partnerships appeal to professional services where multiple partners contribute expertise:

General Partnership

Limited Partnership (Commandite)

Sole Proprietorship

Individual Bahraini nationals may register as a sole proprietorship for certain business activities. This option typically remains unavailable to foreign investors, who instead utilize Single Person Company structures for equivalent legal protection.

The Official 7-Step Company Formation Process

Step 1: Security Clearance from Immigration Authority

Required Documents

- Clear passport copies for all shareholders

- Completed Know Your Customer (KYC) forms

- Background information as requested

- Recent photographs (passport style)

Processing Time

Step 2: Commercial Name Reservation

Naming requirements:

Permitted:

- Personal names of shareholders

- Invented brand names reflecting your commercial activity

- Industry descriptors combined with distinctive elements

- Unique combinations distinguishing your business

Prohibited:

- Religious references or sacred terminology

- Political affiliations or governmental implications

- Existing trademark violations (local or international)

- Generic single words without qualifiers

- Names misleading regarding business activities

Reservation process:

Submit three alternative business names through the Sijilat portal for Ministry review. Name Reservation typically processes within 1 to 3 business days, with your approved commercial name remaining valid for 60 days.

If your first choice faces rejection, the Ministry reviews your alternative selections. Common rejection reasons include similarity to existing registrations, trademark conflicts, or prohibited terminology.

Step 3: Registered Office Address

Address options:

Traditional Office Space

- Free with our Company Formation Packages

- Virtual office solutions (BHD 400-800/year)

- Business center addresses (BHD 1,200/year)

- Incubation center addresses (BHD 600/year)

- Traditional office space

- 20 sqm workshop in industrial areas (BHD 150-200/month)

Virtual Office Solutions

- Free with our Company Formation Packages

- Virtual office solutions (BHD 400-800/year)

- Business center addresses (BHD 1,200/year)

- Incubation center addresses (BHD 600/year)

- Traditional office space

- 20 sqm workshop in industrial areas (BHD 150-200/month)

Business Centers and Incubators

- Serviced office arrangements with flexible terms

- Access to meeting rooms and professional facilities

- Suitable for startups and growing businesses

- Often includes administrative support services

Step 4: Preparing the Memorandum of Association and Articles of Association

These legal documents define your company structure, governance framework, and operational rules.

The Memorandum of Association establishes:

- Company legal name (Arabic and English if applicable)

- Registered office address

- Business activities and commercial objectives

- Authorized capital and share structure

- Shareholder information and ownership percentages

- Company duration and dissolution provisions

The Articles of Association detail:

- Shareholder rights and obligations

- Management appointment procedures

- Decision-making thresholds and voting mechanisms

- Profit distribution arrangements

- Meeting requirements and governance protocols

- Dispute resolution procedures

These documents must align with Commercial Companies Law standards. The Ministry of Industry reviews your Memorandum of Association and Articles of Association for regulatory compliance before granting approval.

Professional service providers can draft these instruments following statutory requirements, or you may adapt standardized templates provided through the Sijilat portal.

Step 5: Notarization of Company Documents

Notary requirements:

- Original passports for identity verification

- All shareholders present simultaneously

- Signatures executed in notary’s presence

- Official seals and attestations applied

Power of Attorney alternative:

- Original passports for identity verification

- All shareholders present simultaneously

- Signatures executed in notary’s presence

- Official seals and attestations applied

Step 6: Corporate Bank Account Opening and Capital Deposit

Ministry regulations now mandate corporate bank account establishment before Commercial Registration certificate issuance. This requirement ensures financial legitimacy and capital verification.

Bank account opening documentation:

- Notarized Articles of Association

- Passport copies for all shareholders

- Six months’ personal bank statements (English, bank-sealed)

- Business plan outlining operations and projections

- Proof of registered office address

- Source of funds declarations

Processing speed by institution:

- Fast-track banks: 1 to 3 business days

- Standard processing: 5 to 10 business days

- Enhanced due diligence: 2 to 6 weeks

Once approved, deposit your declared capital and obtain a capital deposit certificate. This document proves financial commitment and enables final registration completion.

Bank selection considerations:

- Processing speed and efficiency

- International payment capabilities

- Multi-currency account options

- Relationship management quality

- Industry-specific expertise

- Future credit facility availability

Step 7: Commercial Registration Certificate Issuance

Submit all required documents to the Ministry of Industry and Commerce through the Sijilat portal for final review:

- Notarized Memorandum of Association and Articles of Association

- Bank capital deposit certificate with IBAN details

- Municipality office address approval

- Security clearance confirmations

- Name Reservation certificate

- Fee payment confirmation

The Ministry conducts comprehensive review and issues your Commercial Registration certificate within 1 to 2 business days. This certificate authorizes legal business operations across your approved commercial activities.

- Unique registration number

- Company legal name

- Registered address

- Authorized business activities

- Shareholder information

- Capital details

- Validity period (requires annual renewal)

Capital Requirements and Investment Thresholds

Capital Requirements by Entity Type

| Company Type | Minimum Capital | Notes |

|---|---|---|

| W.L.L | None legally required | Banks may request adequate capitalization |

| Single Person Company | None legally required | Activity-dependent guidelines |

| B.S.C Closed | Statutory minimum applies | Formal governance required |

| B.S.C Public | Higher statutory minimum | Public offering structure |

| Branch Office | None | Parent company backing |

| Partnership | None | Partner-determined |

While no legal minimum capital exists for Limited Liability Company structures, banks typically require sufficient deposits demonstrating business viability. Regulated sectors often impose higher capital requirements based on the nature of operations and regulatory oversight.

Sector-specific thresholds:

- Financial services: Central Bank of Bahrain approval with enhanced capital

- Insurance companies: Substantial minimums per regulations

- Investment firms: Risk-based capital adequacy requirements

Review your business plan to determine appropriate capitalization levels supporting operational needs and banking relationships.

Foreign Ownership Regulations and Investment Framework

100% Foreign Ownership Activities

The Kingdom permits complete foreign ownership across 416 commercial activities without requiring local partners. These span diverse sectors:

Approved categories include:

- Information technology and software development

- Professional consultancy and business services

- International trading and import-export operations

- Manufacturing and industrial production

- Healthcare services and medical practices

- Educational institutions and training centers

- Hospitality operations and tourism services

- Engineering and technical consulting

- Marketing and advertising agencies

- Logistics and supply chain management

Activities Requiring Bahraini Partnership

Certain strategic sectors mandate Bahraini national participation as local partners:

- Small-scale retail operations (specific categories)

- Exclusive agency and distribution agreements

- Local transportation services

- Select personal service activities

For restricted business activities, foreign investors must structure ownership with Bahraini nationals or GCC nationals holding minimum percentages as required.

Enhanced Access Through Bilateral Agreements

International treaties provide expanded opportunities:

United States investors: Access to 557 activities under the US-Bahrain Free Trade Agreement

United Kingdom nationals: Enhanced provisions through bilateral investment arrangements

GCC countries citizens: Access to 570 activities under Gulf Cooperation Council frameworks

Verify your specific nationality’s access rights during the planning phase.

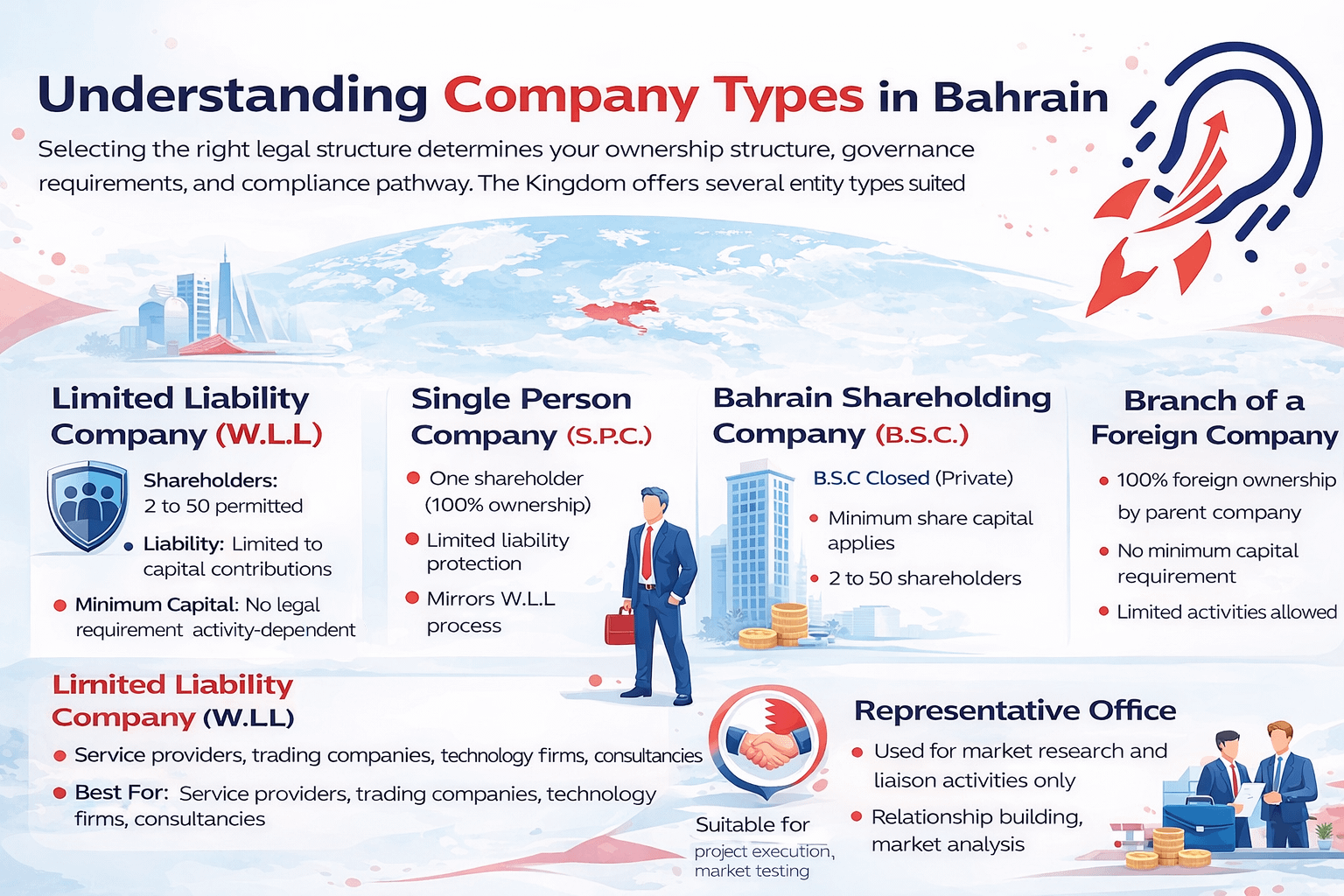

Required Documents Comprehensive Checklist

Individual Shareholder Documentation

- Clear passport copies

- Office Lease Agreement

- Business summary (2-3 pages)

- 6 months’ bank statement of the shareholder’s personal account.

- Draft Deed of Association

Corporate Shareholder Documentation

-

Security Clearance: 3–5 days

-

Commercial Name Approval: 1–3 days

-

Office Approval: 4–5 days

-

Notary & Bank Account Opening: 1–3 days

-

Final CR Issuance: 1–2 days

The timeframe is mentioned in business days.

Company Formation Documentation

- Business plan (2 to 5 pages outlining operations and financial projections)

- Lease agreement for registered address

- Memorandum of Association (MOIC-approved)

- Articles of Association (notarized)

- Municipality address approval certificate

- Bank account opening application material.

Ensure complete documentation before initiating the process to avoid delays during the Company Registration Process.

Post-Registration Statutory Obligations

- Expanding business operations

- Higher capital investment

- Larger office space commitments

- Proven revenue generation

- Valid employment contracts (LMRA-approved format)

- Employee passport copies

- Medical examination completion

- Work permit fees as per LMRA regulations

- Mandatory health insurance coverage per employee.

- Two-year renewable residency authorization.

- Self-sponsorship (no employer required).

- Family sponsorship capabilities.

- Freedom to manage business operations.

- Access to local services and banking.

- Retirement and pension benefits

- Disability protection programs

- Survivor benefits for dependents

- Unemployment insurance

- Current lease agreement (if address unchanged)

- Confirmation of continued business operations

- Updated financial information (for certain entity types)

- Renewal fee payment

- Any amendments to company structure or activities

Labour Market Regulatory Authority Registration

After receiving your Commercial Registration certificate, register with the Labour Market Regulatory Authority (LMRA) to sponsor work permits for employees.

Initial allocation:

New companies receive an initial quota of 2 work permits. Increase this allocation by demonstrating:

Work permit application process:

Processing typically completes within 3 to 7 business days.

Investor Visa for Shareholders and Management

Company shareholders and designated managers qualify for Investor Visa status, granting residency rights in the Kingdom.

Investor Visa benefits:

Social Insurance Organization Enrollment

Companies hiring Bahraini nationals must register with the Social Insurance Organization (SIO), covering:

Contribution rates vary based on employee categories and wage levels.

Value Added Tax Registration

The National Bureau for Revenue administers VAT compliance. Registration requirements:

Mandatory registration: Annual taxable supplies exceed the prescribed threshold

Voluntary registration: Below threshold but claiming input VAT credits beneficial

Current VAT rate: 10% on most goods and services

Exemptions: Healthcare, education, local passenger transport, residential property sales

Annual Commercial Registration Renewal

Your Commercial Registration certificate requires annual renewal through the Sijilat portal. Submit renewal applications 60 days before expiration to avoid penalties and business interruptions.

Renewal documentation:

Late renewal penalties escalate based on delay duration, potentially resulting in registration suspension.

Industry-Specific Licensing Beyond Commercial Registration

Financial Services Licensing

Companies providing banking, insurance, investment management, or related services require:

- Central Bank of Bahrain regulatory approval

- Enhanced minimum capital requirements

- Qualified management and staff credentials

- Ongoing compliance and reporting obligations

- Risk management frameworks

- Audit requirements

The Central Bank maintains rigorous oversight while enabling access to regional financial markets.

Healthcare Services Authorization

Medical clinics, hospitals, diagnostic centers, and healthcare providers need:

- National Health Regulatory Authority (NHRA) licensing

- Professional credentials for medical staff

- Facility compliance certifications

- Medical equipment approvals

- Quality standards maintenance

- Patient safety protocols

Education and Training Approvals

Educational institutions and training centers require:

- Ministry of Education operational approval

- Curriculum verification and accreditation

- Qualified instructor credentials

- Facility standards compliance

- Student protection mechanisms

Food and Beverage Permits

Restaurants, cafes, catering operations, and food production require:

- Ministry of Health food safety licenses

- Facility health inspections

- Hygiene compliance certifications

- Food handler training documentation

- Regular renewal inspections

Professional Services Registration

Certain professional activities need:

- Professional body registration (lawyers, accountants, engineers)

- Individual practitioner licensing

- Continuing education compliance

- Professional indemnity insurance

Engage with relevant authorities early to understand specific licenses needed for your planned business operations.

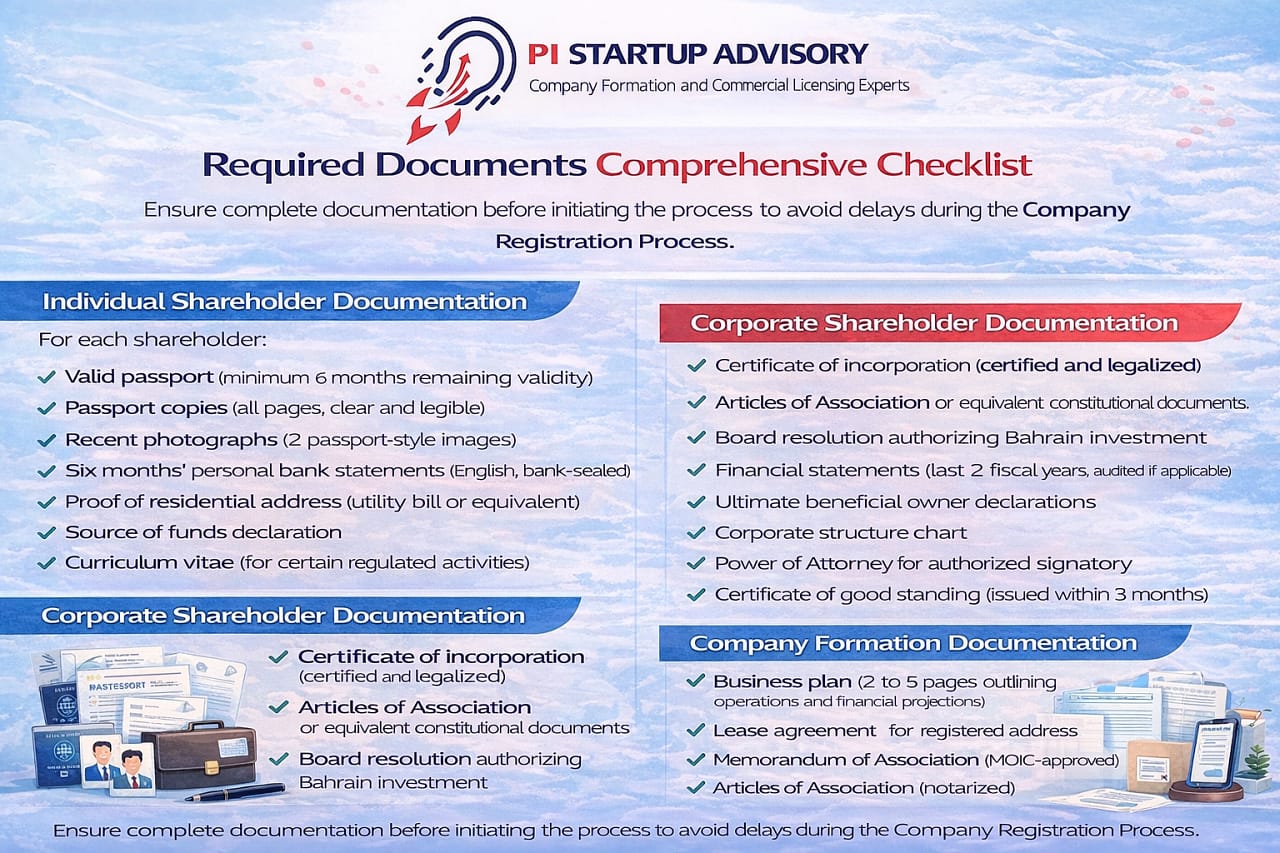

Practical Timeline and Cost Expectations

Typical Formation Timeline

| Phase | Duration | Variables Affecting Speed |

|---|---|---|

| Security clearance | 3–7 business days | Nationality, documentation quality |

| Name reservation | 1–3 business days | Name uniqueness, compliance |

| Office address approval | 2–5 business days | Municipality workload, inspections |

| Document preparation | 2–4 business days | Complexity, professional assistance |

| Notarization | Same day | Shareholder availability |

| Bank account opening | 1–42 business days | Bank selection, due diligence depth |

| CR issuance | 1–2 business days | Documentation completeness |

| Total Range | 11–63 business days | Bank account = primary variable |

Bank account opening represents the most unpredictable timeline factor. Fast-track options exist with certain institutions, while others conduct extensive due diligence procedures.

Investment Considerations

Professional Services:

- Legal consultation and document preparation

- Government liaison services

- Application processing management

- Regulatory compliance guidance

Government Fees:

- Name registration charges

- Commercial Registration fees

- Municipality approvals

- Document processing

Office Address:

- Virtual Office (economical option)

- Serviced offices (moderate investment)

- Dedicated premises (higher commitment)

Banking Requirements:

- Minimum deposits per bank policies

- Account opening fees

- Monthly maintenance charges

Common Misconceptions About Company Formation in Bahrain

“A Local Sponsor is Always Mandatory”

“Registration Takes Months to Complete”

Reality: With proper document preparation, companies complete registration within 11 to 21 business days through the streamlined Sijilat portal. Delays typically result from incomplete documentation or bank account processing, not the registration system itself.

“Corporate Tax Applies to All Businesses”

Reality: Most commercial activities operate tax-free. Corporate income tax applies exclusively to oil and gas operations and certain banking activities. The Kingdom’s zero-tax framework remains a core competitive advantage.

“Multiple Bahrain Visits Are Required”

Reality: While physical presence is necessary for notarization and bank account opening, most steps complete online through the Sijilat portal. A Power of Attorney enables representatives to handle required in-person steps.

“Any Business Name Passes Approval”

Reality: The Ministry of Industry enforces strict naming guidelines. Religious terminology, political references, and trademark violations face automatic rejection. Submitting three alternative names increases approval probability.

“Virtual Office Works for Every Activity”

Reality: Virtual Office solutions suit many service-based operations, but certain activities require physical premises. Municipality authorities assess address suitability based on your specific commercial activity.

Bahrain Compared to Other GCC Markets

Advantages Over Saudi Arabia

- Lower minimum capital requirements across entity types

- Faster average registration timeline (11-21 days vs 20-45 days)

- More established international business infrastructure

- Streamlined processes for foreign investors

- Zero corporate tax (vs 20% in Saudi Arabia)

Advantages Over United Arab Emirates

- No corporate tax on most businesses (UAE introduced 9% in 2023)

- Lower overall cost of business operations

- Less competitive market entry (earlier-stage ecosystem)

- Comparable 100% foreign ownership provisions

- More compact geography (easier logistics)

Advantages Over Other GCC Countries

- Most advanced e-government services (Sijilat portal)

- Efficient judicial system for dispute resolution

- Transparent regulatory environment

- Multicultural, expat-friendly business environment

- Strong intellectual property protection framework

- Advanced banking and financial services sector

Selecting the Right Company Type for Your Objectives

For Small to Medium Enterprises

Recommendation: Limited Liability Company (W.L.L)

Advantages:

- Personal asset protection through limited liability

- Flexible management without Board requirements

- No minimum capital obligations

- Straightforward compliance procedures

- Suitable for 2-50 shareholders

For Solo Entrepreneurs

Recommendation: Single Person Company

Advantages:

- 100% ownership control

- Individual decision-making authority

- Same legal protections as multi-shareholder W.L.L

- Simplified governance structure

- Personal liability limited to capital contribution

For Large Capital Projects

Recommendation: Bahrain Shareholding Company (B.S.C)

Advantages:

- Appropriate structure for significant investments

- Professional governance through Board of Directors

- Facilitates capital raising through share issuance

- Enhanced credibility for major contracts

- Clear shareholder rights framework

- Can access public capital markets (if B.S.C Public)

For International Corporations

Consider: Branch Office vs. Subsidiary

Branch Office advantages:

- Extension of parent company operations

- No separate legal entity creation

- Simplified governance

- Centralized control

Subsidiary (W.L.L or BSC) advantages:

- Independent legal entity with local identity

- Limited liability protection for parent company

- Greater operational autonomy

- Can own real estate and assets

- Easier future sale or restructuring

Selection depends on liability preferences, operational independence requirements, and long-term strategic objectives.

Growth Sectors Attracting Foreign Investment

Technology and Innovation

Information technology companies, software developers, and fintech startups benefit from:

- Bahrain FinTech Bay innovation ecosystem

- Government digital transformation initiatives

- Access to regional technology markets

- Skilled multilingual workforce

- Modern telecommunications infrastructure

- Supportive regulatory environment for innovation

Financial Services Excellence

The Central Bank of Bahrain has established the Kingdom as a regional financial center through:

- Islamic banking expertise and institutions

- Conventional banking infrastructure

- Investment management facilities

- Insurance and takaful services

- Regulatory clarity and stability

- Access to GCC wealth management markets

Logistics and Trading Hub

Geographic positioning between Saudi Arabia and regional markets creates opportunities for:

- Import-export operations

- Regional distribution centers

- Supply chain management

- E-commerce fulfillment

- Cross-border trading platforms

Professional Services Growth

Consultancy, legal, accounting, and business services thrive due to:

- Concentration of corporate headquarters

- Regional business expansion activity

- Cross-border transaction complexity

- Government procurement opportunities

- Skilled professional workforce availability

Frequently Asked Questions

How long does company formation in Bahrain actually take?

The complete process typically requires 11 to 21 business days from initial security clearance application to Commercial Registration certificate issuance. Timeline variations depend primarily on bank account opening speed, which ranges from same-day approval at certain institutions to several weeks for applications requiring enhanced due diligence. Proper documentation preparation accelerates the process significantly

Can foreign investors own 100% of a company without restrictions?

Yes, foreign investors can own 100% of companies across 416 approved commercial activities without requiring Bahraini national partners. Enhanced access exists for United States investors (557 activities) and other bilateral agreement countries. Activities outside these categories may require local partner participation with specific ownership percentages.

What minimum capital is required to register a company?

Limited Liability Company (W.L.L) and Single Person Company structures have no legal minimum capital requirements. Bahrain Shareholding Company (B.S.C Closed) requires BHD 250,000 minimum, while Public Shareholding Company requires BHD 1,000,000. Banks may request adequate capitalization based on business plan assessment, and regulated sectors impose specific capital thresholds.

Is physical presence in Bahrain necessary during registration?

Physical presence is mandatory for notarization of the Articles of Association and corporate bank account opening procedures. However, shareholders can authorize representatives through a properly prepared Power of Attorney to complete these steps. Most other registration steps, including name reservation and document submission, complete online through the Sijilat portal.

What are the actual tax obligations for companies?

No personal income tax applies to employment income. No corporate tax applies to most business activities—exceptions include oil and gas operations and certain banking categories. The Kingdom imposes 10% Value Added Tax on applicable goods and services. Companies must register for VAT if annual taxable supplies exceed BHD 37,500.

Which banks process account opening fastest?

Processing speed varies significantly by institution and application complexity. Some banks complete account opening within 1 to 3 business days for straightforward applications. Standard processing typically requires 5 to 10 business days. Complex cases involving enhanced due diligence may extend to 2-6 weeks. Your selection should consider banking relationship needs beyond processing speed, including international payment capabilities, industry expertise, and future credit facilities.

Can business activities be changed after registration?

Yes, companies can amend their business activities by submitting modification requests through the Sijilat portal with updated Articles of Association and supporting documentation. The Ministry of Industry and Commerce reviews amendments, typically approving within 3 to 7 business days for straightforward changes. Some modifications may require additional approvals from sector regulators.

What happens if the chosen company name is rejected?

The Ministry of Industry provides rejection reasons through the Sijilat portal. You can immediately submit alternative business names from your original three submissions, or propose new options addressing the rejection reason. Common rejection causes include trademark conflicts, prohibited terminology, or excessive similarity to existing registered companies. The resubmission process typically resolves within 1 to 3 business days.

Next Steps to Launch Your Bahrain Business

Phase 1: Strategic Assessment

Define your foundation:

- Clarify your commercial activity and target market

- Assess capital requirements and funding sources

- Determine optimal company structure based on business needs

- Identify required licenses beyond basic registration

- Establish realistic timeline expectations

Phase 2: Documentation Preparation

Gather essential materials:

- Compile shareholder identification documents and passport copies

- Obtain recent bank statements (six months, English, sealed)

- Draft preliminary business plan outlining operations

- Prepare source of funds documentation

- Research office address options and requirements

Phase 3: Professional Guidance (Optional)

Consider expert assistance for:

- Complex ownership structures

- Regulated industry compliance

- Time-sensitive launches

- International parent company coordination

- Banking relationship optimization

Professional service providers expedite registration while ensuring compliance with evolving regulations.

Phase 4: Registration Execution

Follow the official sequence:

- Submit security clearance applications

- Reserve company name through Sijilat portal

- Secure and approve office address

- Prepare Memorandum of Association and Articles of Association

- Complete notarization procedures

- Open corporate bank account and deposit capital

- Submit final documentation for Commercial Registration certificate

Phase 5: Post-Registration Activation

Complete operational setup:

- Register with Labour Market Regulatory Authority

- Apply for Investor Visa and work permits

- Obtain sector-specific licenses where required

- Register for Value Added Tax if applicable

- Open additional banking relationships if needed

- Establish accounting and compliance systems

- Commence authorized business operations

The Bahrain Advantage: A Final Perspective

The Kingdom of Bahrain offers foreign investors a compelling proposition: zero-tax operations, 100% ownership opportunities, efficient digital registration, and strategic access to trillion-dollar regional markets. Whether establishing a new company as an entrepreneur or expanding international business operations through a corporate subsidiary, the streamlined registration framework supports diverse commercial objectives.

The mature regulatory environment, overseen by respected institutions like the Ministry of Industry and Commerce and the Central Bank of Bahrain, provides stability and transparency that global businesses require. Combined with advanced infrastructure, a skilled workforce, and cultural diversity, the Kingdom positions itself as an ideal platform for Middle East market entry.

Success requires understanding the legal structure options, following the official Company Formation Process systematically, and maintaining ongoing compliance with statutory obligations. With proper planning and execution, foreign investors establish thriving operations contributing to the Kingdom’s dynamic business environment while achieving their growth objectives across the Gulf region and beyond.

Regulatory Framework: Commercial Companies Law (Decree Law No. 21 of 2001, as amended)

Registration Portal: Sijilat (www.sijilat.bh)

Primary Authority: Ministry of Industry and Commerce

Last Updated: February 2026