Avoid confusing paperwork and long waits. PI Startup Advisory helps expats and residents open bank account in Bahrain quickly, securely, and with full support. With years of experience in bank account opening in Bahrain, we know the challenges and how to overcome them for fast approvals. We guide you to the right bank and ensure your application is correct the first time. Let’s have your personal bank account in Bahrain in only 1 day

Table of Contents

Why Open a Personal Bank Account in Bahrain?

Bahrain’s banking system is modern, secure, and offers a wide range of personal financial services for expats and residents. A personal account allows you to:

- Receive salary or freelance income

- Pay bills and rent

- Transfer money internationally

- Save securely

- Access mobile and internet banking

Whether you’ve just moved or have been here for a while, a local bank account simplifies daily life.

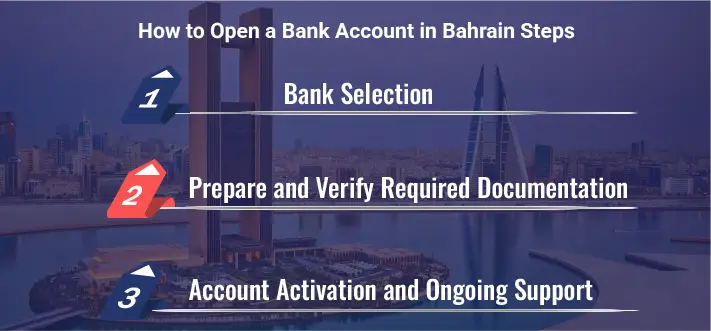

How to Open a Bank Account in Bahrain | Step-by-Step Guide

Opening a personal bank account in Bahrain is generally easier than setting up a corporate account, but it still involves documentation checks and bank-specific processes. PI Startup Advisory simplifies this process for expats by matching your profile with the right bank and handling every step to ensure a smooth experience.

Step # 1: Bank Selection

Step # 2. Prepare and Verify Required Documentation

Step # 3. Account Activation and Ongoing Support

Step 1. Bank Selection

We help you select the ideal personal bank based on convenience, onboarding speed, and documentation profile. Popular options include:

- Ila Bank: A 100% digital bank offering instant onboarding via a mobile app. Perfect for tech-savvy expats who want to avoid paperwork and branch visits.

- Al Salam Bank: Known for being expat-friendly, this bank requires fewer documents and offers fast in-branch onboarding. It also provides Islamic (Sharia-compliant) banking options.

- NBB: NBB is a government-owned bank that offers online account opening, with no physical appearance required.

- BBK: BBK is known for its most competitive bank account, which facilitates easy international transactions.

- BISB: BISB also offers online account opening, and it provides an Islamic (Sharia-compliant) banking system.

We will guide you on the best option for your situation and help initiate the process.

Step 2. Ensure Compliance with Requirements

To avoid delays or rejections, we assist in verifying and compiling the required documents. While requirements vary slightly by bank, the general list includes:

- Legal Documents: Valid Passport, Residence Visa, and CPR

- Proof of Bahrain Address: CPR Extract

- Employment Letter or Salary Certificate: It is required by the banks.

- Minimum Required Capital: BHD 20

Step 3. Account Activation and Ongoing Support

Once your account is opened, we will continue to assist you with the setup and address any issues that may arise. Our post-opening support includes:

- Mobile and Internet Banking Setup

- ATM and Debit Card Access

- Salary Deposit Setup or Linking with Payment Sources

- Help with Bank Communications or Troubleshooting

With PI Startup Advisory, opening a personal bank account in Bahrain is straightforward, efficient, and tailored to your needs as an expat.

Can You Open a Bank Account Online in Bahrain?

Bahrain offers a range of possibilities for commercial buildouts. Each has its benefits based on your commercial needs. Lastly, here are the most common types of companies in Bahrain.

1. ila Bank

- Allows personal account opening through its mobile app in just a few minutes and offers digital onboarding with account setup possible within one day.

- It is currently available only for personal bank accounts.

- Ila Bank is considered one of the best bank account in Bahrain for users who prefer mobile access.

2. BisB (Bahrain Islamic Bank)

- BisB offers a mobile application process for personal and corporate accounts.

- It combines speed with Sharia-compliant banking features, making it a convenient option for personal and business bank accounts.

3. HSBC Bahrain

Also supports international clients who want to open accounts in Bahrain.

Offers online account opening for both savings and current accounts.

Things to Keep in Mind

Our team can guide you through the most efficient route based on your business profile.

- Online account opening is convenient, but you must still meet the bank’s eligibility requirements.

- Ensure you have the necessary documents ready before beginning the process.

- Each bank may have different steps depending on the account type and your residency status.

These digital solutions are ideal for minimizing paperwork and avoiding long wait times.

Ready to Open Bank Account in Bahrain? Let’s Get Started.

Whether you’re launching a business or managing your personal finances, opening the right bank account in Bahrain is a key step. From choosing the best bank to handling all paperwork and follow-ups, PI Startup Advisory does the heavy lifting so you don’t have to. Get expert assistance for your personal bank account fast, compliant, and stress-free.

Common Mistakes Expats Make (And How We Fix Them)

Many expats face delays due to avoidable issues. We resolve these before submission:

- Incomplete Documents: We ensure everything is complete and valid

- Inconsistent Address Proof: We help you use the correct and acceptable documents

- Language Barriers: Our multilingual team bridges gaps with bank staff

- Bank Selection Errors: We match your profile with banks most likely to approve

Why PI Startup Advisory is Your Trusted Partner in Bahrain

We’ve helped hundreds of expats in opening a bank account in Bahrain quickly by simplifying documents and fast-tracking the application process.

- 6 Years+ Expertise: Deep understanding of Bahrain’s banking regulations and requirements.

- Strong Bank Relationships: Established relationships with major banks for expedited processing.

- Client Diversity: Serving both local and primarily international clients across various industries.

- Quick In Tasks: Fast processes to get your account up and running within a day.

Frequently Asked Questions

Can foreigners open personal bank accounts in Bahrain?

Yes. Expats with a valid CPR or residence visa can open a personal account, subject to bank-specific document checks.

Which bank is best for expats in Bahrain?

Ila Bank: Best for digital experience

Al Salam Bank: Fast approvals, minimal paperwork

Ithmaar Bank: Friendly for Asian expats and multilingual support

Can I open a bank account without visiting a branch?

Yes, some banks, such as Ila Bank, allow whole online account opening via their mobile apps.

How long does it take to open a personal bank account?

With PI Startup Advisory, most accounts are opened within 2-3 business days.

Do I need a salary certificate?

Some banks require it; others waive it for savings or low-transaction accounts. We guide you based on your profile.