How to Register for VAT in Bahrain?

If you want to run a business, you must understand VAT in Bahrain. This tax applies when your sales reach a certain yearly amount. Many business owners feel confused about how to register for VAT. Some people are unsure when to register or what documents they need. Others are unsure how to file or claim VAT refunds.

This blog post aims to address those problems in simple terms. You will learn who is required to register and who can register voluntarily. We will show the whole step-by-step process of VAT registration. You will see the required documents and learn how to apply online. We will also explain how to check your VAT number and log in to the NBR portal.

You’ll also find details about the Bahrain VAT exemption list, refunds, penalties, and deregistration rules. This guide covers everything a person must know about VAT in Bahrain in 2025.

Table of Contents

What is VAT in Bahrain?

The value-added tax (VAT) in Bahrain has a rate of 10%, which is applied to goods and services sold within the country. VAT was first introduced in Bahrain in 2019, as part of a Gulf Cooperation Council (GCC) agreement.

Legal Framework and Oversight

VAT in Bahrain is governed by Decree-Law No. (48) of 2018, which was issued in 2019. The National Bureau for Revenue (NBR) enforces this law. The Bahrain VAT law defines taxable persons, goods, services, and obligations.

Types of Supplies

The law splits supplies into three groups:

- Standard-rated products: 10%

- Zero-rated products: 0%

- Exempt Supplies: Nil

Recent and Future Changes

First, the VAT implemented by the Bahrain government was only 5% in 2019; however, the rule changes in 2022 were progressive, and a 10% VAT was introduced. However, as of 2025, we still have the same Bahrain VAT percentage, and rates have not changed. If there is any change, it will be directly updated by the NBR of Bahrain.

Understanding the Bahrain VAT Rates

The standard Bahrain VAT rate is 10 percent. It applies to most goods and services. Businesses must charge this rate unless exemptions apply. You must list this VAT clearly on your invoices.

Zero-Rated Supplies

Zero-rated items are taxed at 0 percent. These include education, healthcare, and necessities such as food. You still file VAT returns and can claim input VAT for zero-rated goods and services.

Exempt Supplies

Exempt supplies are not taxed at all. These include financial services, residential property leases, and specific educational services. You cannot charge VAT or claim input tax on exempt supplies.

VAT Registration Requirements in Bahrain

Before registering, consider whether or not you meet the criteria for legal and financial requirements.

Eligibility and Threshold

Annual Turnover VAT Registration

Less than BHD 18,500 Not Eligible

More than BHD 18,500 Eligible

More than 37,500 Mandatory

If your taxable turnover is BHD 37,500 or above in a year, you must register. If your turnover is BHD 18,750 or above, you can still register voluntarily. Non-resident businesses must register before making taxable supplies. They don’t need to meet a threshold.

Documents Required

To register, you must have:

- Copy of CR (e-Certificate).

- Copy of e-Extract.

- Copy of applicant’s CPR.

- Audited financial report for the last financial year (for companies more than 2 years old).

- Monthly sales from the date of incorporation to date.

- Sales & Purchases forecast of the next 12 months’ taxable, zero-rated, and exempt supplies.

- Explanation of exempt and zero-rated supplies on the company’s letterhead (if any).

- Purchase and Sales invoices, contracts, and other supporting documents proving registration eligibility.

- IBAN certificate or Bank Statement.

- A letter from the company mentioning the contact person’s details, such as Name, CPR, phone, and email address.

Above mentioned documents will help the NBR to verify your application.

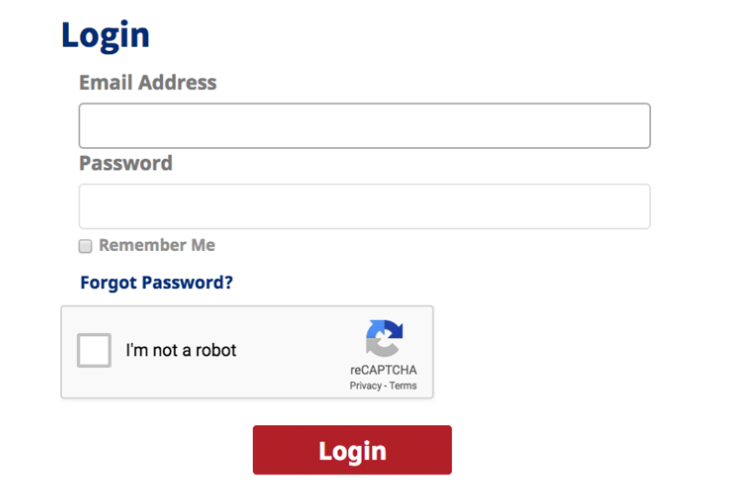

NBR Portal Access

Visit the Bahrain VAT login portal at NBR’s official website. Fill out the form and upload your documents online. After review, you’ll get your VAT registration number. You must check this number to confirm your status. Always use the correct login details and save your access credentials.

Step-by-Step Process to Register for VAT in Bahrain

The registration process is entirely online through the NBR VAT portal. You will need to provide valid documents and accurate business details to proceed with your application.

Step 1: Estimate Your Turnover

Please cross-check your annual turnover for the last 12 months. If your annual turnover exceeds BHD 37,500, VAT registration is mandatory for you. However, if the turnover exceeds only BHD 18,750, you may register voluntarily. Non-resident businesses must register for VAT before any taxable transaction.

Step 2: Prepare Necessary Documents

You must collect the required files before applying online. These include your:

- Copy of CR (e-Certificate).

- Copy of e-Extract.

- Copy of applicant’s CPR.

- Audited financial report for the last financial year (for companies more than 2 years old).

- Monthly sales from the date of incorporation to date.

- Business plan with a precise forecast of the next 12 months’ taxable, zero-rated, and exempt supplies.

- Explanation of exempt and zero-rated supplies on the company’s letterhead (if any).

- Purchase and Sales invoices, contracts, and other supporting documents proving registration eligibility.

- IBAN certificate or Bank Statement.

- A letter from the company mentioning the contact person’s details, such as Name, CPR, phone, and email address.

Step 3: Create an NBR Profile

Visit the official Bahrain VAT login portal at the National Bureau for Revenue (NBR) website. Click “Create NBR Profile” to begin. Read the instructions, check the agreement box, and proceed.

Fill the form with:

- CR details

- Financial information

- Taxpayer and contact address

- Registrant’s personal data

You have to upload your document as proof for the registration.

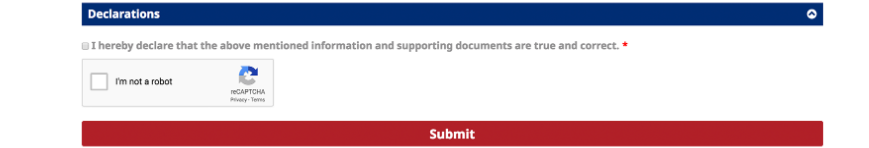

Step 4: Submit Declaration and Wait for Verification

After completing the form, check the declaration box. Then submit your VAT registration request. NBR will send a confirmation email.

They will review your documents and details. This can take a few working days.

Step 5: Log in and Confirm Registration

Once NBR approves your request after reviewing your documents, you will receive your account credentials via email. You can log in to complete and submit your VAT registration application through it. The NBR will activate your profile after a few moments.

Step 6: Receive VAT Certificate and Start Charging VAT

If approved, you will find your VAT certificate in your profile. This includes your VAT registration number. From this point, you must charge VAT on all taxable sales. Your invoices must display your VAT number and the corresponding VAT amount.

VAT Payment and VAT Filing Bahrain

Once registered, you must file VAT returns and pay VAT on time. Filing and payments are handled through the NBR VAT portal.

VAT Filing Process

You must file VAT returns every quarter. NBR gives each business a fixed filing schedule. Returns must include total sales, purchases, input VAT, and output VAT. Use the online form on the Bahrain VAT login page to submit. All figures must match your invoices and records. File even if your VAT is zero.

How to Make VAT Payment Bahrain

After filing, the system shows how much VAT in Bahrain you owe. The NBR portal allows you to enter the due amounts and contact details to finalize the online payment. When you’re done with the transaction, you can print or email your receipt.

Penalties for Late Filing or Payment

If you miss deadlines, penalties will be applied. NBR charges fines for late filing, underpayment, or false data. Missed deadlines can also delay your repayment of any VAT due. Please ensure your records are clear and up to date to avoid mistakes.

Costs Involved in VAT Registration and Compliance

Registering for VAT in Bahrain is free; however, staying compliant incurs some costs. The size and structure of your business determine those costs.

Administrative Costs

For your administrative costs, you may need support from a tax advisor or VAT consultant. Many businesses opt to hire consultants to avoid mistakes, and these costs vary depending on the services provided and other factors. Small businesses also need to purchase specialist software or tools just to manage their VAT records.

Compliance Costs

In addition to filing a VAT return, other ongoing VAT-related activities include tracking input VAT and maintaining an orderly record of invoices. If you use a tax agent, their fee is also a business cost. Incorrect filings can result in NBR penalties, further increasing costs.

Long-Term Value

While there are costs associated with VAT registration in Bahrain, the long-term benefits are great. You will be able to access VAT credits, as well as contracts and protection, through the legal system. Proper compliance reduces risk and builds business trust.

VAT Deregistration Process in Bahrain

If your business stops taxable activities, you may need to cancel your VAT registration. This is called VAT deregistration.

When to Deregister from VAT

You must deregister if your taxable turnover drops below BHD 18,750. You can also apply if you close the business or stop making taxable supplies. Non-resident companies must deregister if they cease to operate in the Bahrain market.

How to Deregister

Log in to the Bahrain VAT login portal. Go to the deregistration section inside your NBR account. Fill the form and select your reason. Submit all required documents and the final VAT return. NBR will review and confirm your de-registration by email.

Important Notes

If you do not deregister on time, a penalty could be charged. Your final return will contain any remaining VAT Bahrain that becomes due. Remember to keep your records in good order for possible future consideration, even in a case of deregistration.

Why VAT Registration is Important for Businesses in Bahrain

Legal Compliance

Every business in Bahrain is required to comply with the Bahrain VAT Law. If you cross the threshold, you must register for VAT. Failing to register could result in heavy penalties from the National Board of Revenue (NBR). You must also file VAT returns and keep VAT records.

Builds Customer Trust

Registered businesses issue official VAT invoices. Customers trust sellers who follow tax laws. Being VAT registered shows that your business is real and compliant. It makes people more likely to buy from you.

Access to Business Opportunities

Some contracts require a VAT registration number. This includes government and large private tenders. You also need VAT registration for international trade. Many suppliers ask for a VAT certificate before doing business with you. You can also claim input VAT and reduce tax costs.

Common Challenges For Managing VAT In Bahrain

Numerous businesses face challenges managing VAT in Bahrain. Most problems arise from a misunderstanding of the rules or inadequate documentation.

Misunderstanding VAT Categories

Businesses often fail to distinguish between exempt and zero-rated supplies. This means firms charge the wrong VAT or fail to claim VAT completely. If businesses charge VAT to clients, always review the assessment exemption list for Bahrain before raising a bill.

Incomplete or Wrong Documents

Missing or incorrect documents delay registration. Make sure all files match your Commercial Registration (CR). Scan and upload clear copies when applying. If your name or address changes, update NBR records immediately.

Late Filing and Missed Payments

Missing deadlines can lead to high VAT filing penalties in Bahrain. Always track your quarterly due dates. File your return even if your VAT is zero. Pay the correct amount on time to avoid interest or fines.

Portal and Access Issues

Some users face trouble logging into the Bahrain VAT login portal. Save your username, password, and email confirmation safely. If you lose access, contact NBR support quickly.

Benefits of Being VAT Registered in Bahrain

Registering for VAT in Bahrain provides your business with numerous legal and financial benefits. It also increases your trust and standing in the market.

Claim Input Tax Credits

Registered businesses can recover VAT paid on eligible purchases. This reduces the overall tax cost. You subtract input VAT from output VAT when filing your return. This only applies if your supplies are taxable or zero-rated.

Improved Business Credibility

Clients and partners prefer working with VAT registered companies. Your VAT certificate proves that your company is responsible and compliant. It creates trust with local buyers and with international buyers.

Smooth International Trade

Many overseas suppliers ask for a VAT registration number. If you have it, they treat you as a formal partner. It also facilitates the import and export of goods from Bahrain.

Access to Government Contracts

Government projects often require a valid VAT certificate. Being registered opens the door to these deals. You also avoid delays in payments, since your invoices meet tax rules.

Conclusion

All business owners in Bahrain need to be aware of and understand VAT. From checking your turnover to getting your VAT certificate, the process is essential. Filing on time, paying on time, and keeping clean records is not an option; it is a requirement under the law.

Wherever you are at this time, whether registering for VAT, filing VAT, or using the NBR portal, it is your entrance point. You must use it correctly and always comply with the requirements of the Bahrain VAT Law.

Once you are registered for VAT, you can do so much from establishing trust, tax credits, to starting a new business. Don’t risk penalties by staying informed, accurate, and timely!